Last week, the global order volume came to an end. According to Clarkson data, there were a total of 41 orders last week (7.29-8.2), which is at a moderate level. At the beginning of this year, the highest weekly orders were 77 ships from the previous week (7.22-7.26), and the lowest weekly orders were 26 ships from the first week of February (1.29-2.2).

week, there was a surge in orders for a type of ship – chemical tankers, with orders reaching as high as 25 ships, setting a record for the highest number of orders this year. The most eye-catching is the Belgian CMB TECH’s order for 20 ships in Xiangyu, Nantong.

Chemical tankers have a relatively low presence compared to bulk oil tankers. Currently, the largest chemical tanker has a carrying capacity of approximately 60000 tons, making it a relatively small vessel compared to bulk oil tankers. However, since the beginning of this year, there have been 131 new orders for chemical tankers worldwide, accounting for 10.1% of the total global orders of 1378. In terms of order volume, the scale is not small.

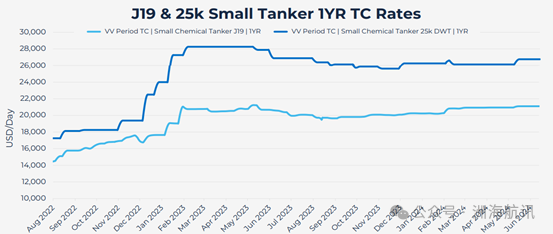

Over the years, there has been insufficient investment in the global fleet of chemical tankers, resulting in a long-term shortage of capacity in thisfield. Coupled with widely reported geopolitical events and environmental changes, this has led to a strong tanker market this year. Over the past 18 months, rental rates for chartering have been steadily increasing. Since August 2022, the one-year rent for J19 chemical tankers and 25K chemical tankers has increased by approximately 45% and 55% respectively. As Udo Lange, CEO of Stolt Nielsen, pointed out, the ship rent in 2023 has remained stable at historical highs. This has brought substantial profits to the shipowner, and based on this fundamental analysis, the shipowner should hold the vessel for an additional 12 to 24 months.

During the annual American Fuel and Petrochemical Producers (AFPM) conference held in San Antonio, Texas in March 2024, the overwhelming consensus among shipowners, brokers, and charterers was that this year’s high freight environment will continue for another two years. There is no indication that rent will not continue to rise in the medium term unless there are significant new legislation or catastrophic geopolitical events.

Trend of 1-year rental for J19&25K chemical tankers

At present, there are 788 18K-55K chemical tankers worldwide, distributed according to their age as follows:

Distribution of 18K-55K fleets by age

According to trade data from VesselsValue, since November 2023, the average year-on-year growth of chemical tanker cargo nautical miles has been about 11%, while ship capacity growth has been slow at only about 2%, with a difference of 9% between the two increments. This imbalance explains why the rent and value of chemical tankers are so high now and may continue until 2026.

Over the past decade, acquisitions, integrations, and mergers have been a prominent feature of the chemical tanker industry. In recent years, there have been frequent high-profile acquisition cases in this field. In 2016, Stolt, the world’s largest chemical shipowner, acquired Norwegian company Jo Tankers for $575 million. Later that same year, Bermuda based Team Tankers took over Eitzen from Norway before completely withdrawing from the field. In 2019, Japan’s MOL acquired Denmark’s Nordic Tankers for an undisclosed amount, followed closely by Dutch shipowner Ace Quantum’s acquisition of Singapore’s BW Chemical fleet for $350 million. Integration and acquisition activities continued during the COVID-19. Chembulk Tankers of the United States handed over its fleet to the Singapore ship owner Womar pools in March 2020, and then the French Songstran Group took over Depoli Tankers of the Netherlands later that year. This trend is expected to continue in 2024. According to VesselsValue data, MOL completed a $400 million acquisition of American shipowner Fairfield in March, adding 81 multi variety chemical carriers to its asset portfolio, bringing its total fleet value to $1.53 billion. However, according to VV’s assessment, the acquisition of small companies by large companies will not go smoothly in the future, as the market seems to be very good.

Driven by high asset value, strong freight rates, and strategic integration, the chemical tanker industry remains a dynamic area for mergers and acquisitions. The current situation of mergers and acquisitions presents unprecedented market characteristics: due to limited supply, asset prices are soaring, which is in sharp contrast to the relatively sluggish situation in previous years.

Since the beginning of this year, the other ship owners with orders exceeding 6 ships are as follows:

1. German GEFO Shipping 10 3850 deadweight ton stainless steel chemical tankers;

2. 6 Norwegian Stolt Tankers 38000 deadweight ton stainless steel chemical tankers;

3. Singapore Pioneer Tanker has 8 18500 deadweight ton chemical tankers;

4. Denmark M H. Six 6800 deadweight ton stainless steel chemical tankers of SIMONNENAPS;

5. Junzheng Group has 20 25900 deadweight ton chemical tankers;

6. Zhejiang Yunxiang Shipping has 6 6800 deadweight ton stainless steel chemical tankers;

7. German TB Marine has 8 22000 deadweight ton chemical tankers;

8. Six 50000 deadweight ton chemical tankers/product oil tankers from Horizon Tankers, Greece;

Among them, Nantong Xiangyu undertakes 36 chemical tankers of various types, accounting for 27% of the total orders.

Overall, high shipping costs are expected to remain high and low order volumes also indicate a continued supply-demand imbalance, and the outlook for chemical vessels remains optimistic.